What are Letters of Administration?

What are "letters of administration" in Victoria? - 9 Things you need to know

Some of us have heard of the words “letters of administration” but don’t know what it is and why and when it is required.

When someone dies without leaving a Will and assets, these are the things you need to know.

1. What are “letters of administration”?

“Letters of administration” are a Court order that gives legal authority to a person or persons to act as administrator(s) of a deceased estate where there is no Will. The authority is to administer and distribute the deceased’s assets according to the “no Will” beneficiary rules in Victoria.

2. Who can apply for “letters of administration”?

The person or persons applying for “letters of administration” must have “standing”.

“Standing” is satisfied if the person(s) has an interest in the deceased’s estate as a beneficiary under the “letters of administration no Will” rules.

3. In Victoria, how do I know if I am a “letters of administration (no Will)” beneficiary?

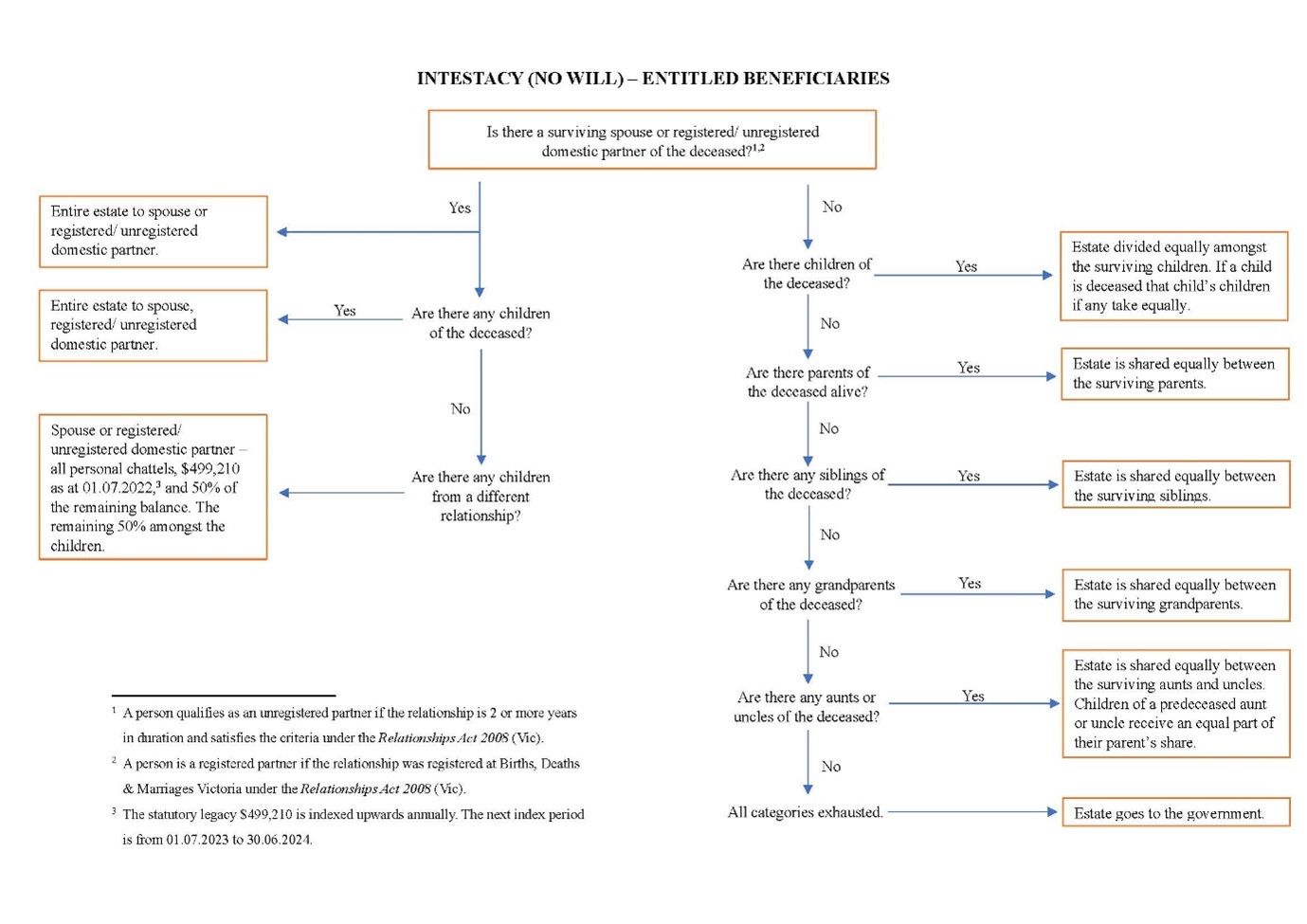

The “no Will” beneficiary rules known as the “intestacy” rules set out based on family, marriage and/or relationship connection who gets what of a “letters of administration (no Will)” estate.

The following link sets out who is a beneficiary of a “letters of administration (no Will)” estate in Victoria.

4. Why are “letters of administration” necessary?

They are necessary if there are “assets” of the estate which the administrator(s) needs to deal with by transfer and/or sale.

The “letters of administration” Court order gives the administrator(s) legal authority to do so.

“Letters of administration” are not always necessary. If assets such as a house or bank accounts are held in the joint ownership of a deceased and co-owner, on the deceased’s passing, 100% of the asset becomes the co-owner’s under the rules of survivorship.

5. If estate assets are left, how soon after someone dies do I apply for “letters of administration”?

There is no strict time requirement but a person with “standing” to make the “letters of administration” application should act in a timely way.

Usually, the process of applying for “letters of administration” should be started within three months from the date of the person deceasing.

6. What is the “letters of administration” process?

A “letters of administration” application is made to the Supreme Court Probate Registry in Victoria.

It requires two steps.

Firstly, placement of an online advertisement on the Court portal giving notice of an intention to apply for “letters of administration”. 14 days from its placement must elapse prior to the application being lodged.

Secondly, “letters of administration” Court documents including an administrator affidavit setting out a list of assets and liabilities needs to be drawn and signed for lodgement.

A certified copy of the death certificate is required in support of the “letters of administration” application.

7. How long does a “letters of administration” application take to complete?

A timeframe of 3 to 4 weeks including the 14-day online advertisement period should be allowed.

8. How much does a “letters of administration” application cost?

The cost depends on the value of the estate.

The Current Allan Labor Government increased application filing fees some 300 – 680% as a quasi-death inheritance tax.

The current filing fees where the gross value of the estate is:

- Less than $250,000 is $0.00;

- $250,000 or more but less than $500,000 is $514.40;

- $500,000 or more but less than $1,000,000 is $1,028.80;

- $1,000,000 or more but less than $2,000,000 is $2,400.50;

- $2,000,000 or more but less than $3,000,000 is $4,801.00;

- $3,000,000 or more but less than $5,000,000 is $7,185.20;

- $5,000,000 or more but less than $7,000,000 is $12,002.60;

- $7,000,000 or more is $16,803.60.

We charge a professional fixed fee of $2,500 (plus GST) in addition to the Court filing fee.

Subject to case circumstances we may agree to act on the basis that we pay the upfront filing fees at first instance with our professional, and filing fees being paid once the “letters of administration” is made and ready estate monies accessed.

9. What happens after “letters of administration” are made?

The administrator can take whatever steps necessary to administer the estate and distribute the deceased’s assets according to the “letters of administration (no Will)” rules in Victoria.

Steps usually include:

- Calling in by transfer and or sale all assets for holding by the administrator(s) as trustee;

- Paying all estate expenses and liabilities; and

- Transferring the deceased’s net estate to the entitled “letters of administration (no Will)” beneficiaries.

Find out more about “letters of administration” in Victoria.

Talk to one of our “letters of administration” lawyers in Victoria now.

Galbally & O’Bryan is one of Victoria’s leading “letters of administration” law firms.

We offer a free first consultation over the phone and “no win no fee” terms.

Partner Andrew O’Bryan and Senior Associate Carl Wilson are expert “letters of administration” lawyers. Andrew and Carl will review your case and provide clear, easy to follow advice and guidance regarding your “letters of administration” matter.

With an office next to the Melbourne Magistrates Court, we practice in Melbourne, Dandenong and Pakenham.

Contact us by email or phone on 03 9200 2533.